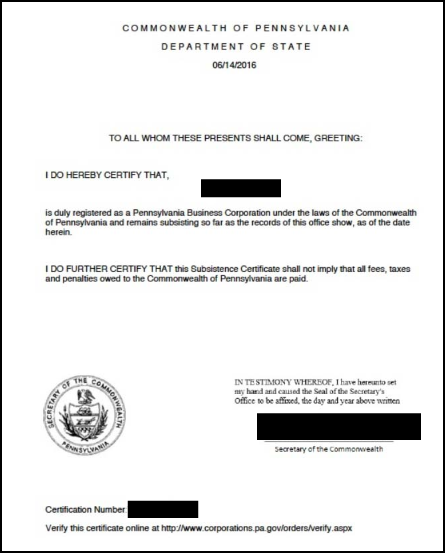

The Pennsylvania Certificate of Good Standing, also referred to as the Certificate of Subsistence for corporations or the Certificate of Registration for LLCs, is issued by the Pennsylvania Department of State. This document confirms that a business entity is legally registered and compliant with Pennsylvania’s regulations, such as filing required reports and paying fees. Whether your business is a corporation, LLC, or nonprofit, a Certificate of Good Standing is often required for activities like securing loans, opening bank accounts, or expanding to other states.

How to Obtain a Certificate of Good Standing in Pennsylvania

In Pennsylvania, you can request a Certificate of Good Standing (Certificate of Subsistence for corporations or Certificate of Registration for LLCs) through the Pennsylvania Department of State. The request process can be completed online, by mail, or in person. Here are the steps:

- Visit the Pennsylvania Business Entity Search portal.

- Search for your business using the entity name or entity number.

- Once your business is located, submit the request for a Certificate of Good Standing by following the on-screen instructions.

- Pay the applicable fee with a credit card for online orders, or use a check if submitting by mail.

- Receive the certificate digitally or by mail, depending on the method you selected.

Pennsylvania Certificate of Good Standing Costs

The costs for obtaining a Certificate of Good Standing in Pennsylvania are as follows:

| Service | Cost |

|---|---|

| Certificate of Good Standing (Standard Processing) | $40 |

Processing Time for the Certificate of Good Standing in Pennsylvania

Pennsylvania offers standard processing times for the **Certificate of Good Standing**. Below are the estimated times:

| Method | Processing Time |

|---|---|

| Online (Standard) | Immediate |

| Mail (Standard) | 2-3 business weeks |

| In-Person (Standard) | Same day |

When Do You Need a Certificate of Good Standing in Pennsylvania?

A Certificate of Good Standing is typically required for specific business transactions or legal purposes, including:

- Opening a business bank account

- Applying for business loans or lines of credit

- Registering your business in another state (foreign qualification)

- Entering into contracts with vendors or clients

- Renewing certain licenses or permits

Most institutions require the certificate to be dated within the last 30 to 90 days to verify that the business is currently in good standing.

What Happens If Your Pennsylvania Business Falls Out of Good Standing?

If your business is not in good standing in Pennsylvania, it may indicate that you’ve missed filing reports or paying state fees. This could result in fines, penalties, or suspension of your business’s operating rights. To regain good standing, you will need to:

- File any overdue annual reports or other required documents

- Pay outstanding fees or penalties

- Ensure compliance with Pennsylvania’s business regulations

Once compliance is restored, you can request a new Certificate of Good Standing to confirm your business’s legal status.

Where to Contact for More Information

If you need further assistance with obtaining your Certificate of Good Standing or have questions about the process, you can contact the Pennsylvania Department of State at:

- Phone: (717) 787-1057

- Address: Pennsylvania Department of State, 401 North Street, Harrisburg, PA 17120

- Website: https://www.pa.gov/en/agencies/dos/programs/business.html