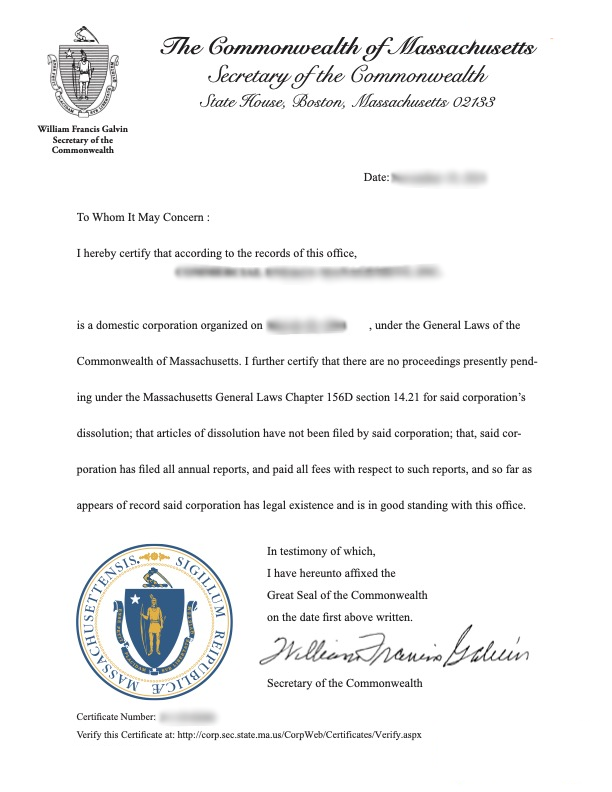

The Massachusetts Certificate of Good Standing is issued by the Secretary of the Commonwealth. This document certifies that a business is legally registered and compliant with the Commonwealth’s regulatory requirements, such as annual report filings and tax obligations. Whether you’re a corporation, LLC, or nonprofit, having this certificate can be crucial for various business activities like opening bank accounts or applying for loans.

How to Obtain a Certificate of Good Standing in Massachusetts

In Massachusetts, you can request a Certificate of Good Standing through the Secretary of the Commonwealth’s office. The process is straightforward and can be done online. Below are the steps:

- Visit the Secretary of the Commonwealth’s website.

- Search for your business using your entity name or entity number.

- Request the certificate by completing the required form.

- Pay the necessary fee using a credit card.

- Download the certificate or receive it by mail depending on your selection.

Massachusetts Certificate of Good Standing Costs

The costs to obtain a Certificate of Good Standing in Massachusetts are as follows:

| Service | Cost |

|---|---|

| Certificate of Good Standing (Standard Processing) | $12 |

| Expedited Processing (Available for online requests) | $20 |

Processing Time for the Certificate of Good Standing

Massachusetts offers both standard and expedited processing options for the Certificate of Good Standing. Below are the processing times:

| Method | Processing Time |

|---|---|

| Online | 1-2 hours (expedited) |

| Mail or In-Person | 2-3 business weeks (standard) |

Difference Between Massachusetts Certificate of Good Standing and Certificate of Existence

In Massachusetts, the Certificate of Good Standing and the Certificate of Existence are often confused because they both confirm that a business is legally compliant. However, there are key differences:

- Certificate of Good Standing: Confirms that your business is properly registered and compliant with all state filing and reporting requirements, such as annual reports and taxes.

- Certificate of Existence: This certificate, also issued by the Secretary of the Commonwealth, simply verifies that the business exists and is registered in the state, without providing details on whether it’s up-to-date with its filing requirements.

It’s important to request the correct certificate based on what is required by third parties, such as banks or state agencies. The Certificate of Good Standing is typically preferred for most legal and financial matters.